We use cookies to help improve our services, make personal offers, and enhance your experience. If you do not accept optional cookies below, your experience may be affected. If you want to know more, please read the Learn more.

Why is there sales tax on my quote or order?

We are required by law to collect sales tax in every applicable state. Presently we are collecting sales tax for taxable orders shipping to the following states:

| Alabama | Illinois | Massachusetts | New York | Texas |

| Arizona | Indiana | Michigan | North Carolina | Utah |

| California | Iowa | Minnesota | Ohio | Virginia |

| Colorado | Kentucky | Nebraska | Oklahoma | Washington |

| Connecticut | Louisiana | Nevada | Pennsylvania | Washington, DC |

| Georgia | Maine | New Jersey | South Carolina | Wisconsin |

| Idaho | Maryland | New Mexico | Tennessee | Wyoming |

What if I am tax exempt?

Ultimately, your state determines whether you qualify for a tax exemption. Please consult your tax advisor or local state department of taxation to determine if you are tax exempt. If you are a tax exempt business or organization shipping to one of the taxable states above, please forward your exemption certificate and completed W-9 to [email protected]. The signature on tax exemption forms requiring a signature must be handwritten. Electronic signatures and stamped signatures will not be accepted.

Resellers & Value-Added Resellers (VARS) - This is a company or individual that purchases goods or services with the intention of reselling them rather than consuming or using them. As a general rule, resellers are tax exempt from sales tax in every state if they can provide a valid resale certificate.

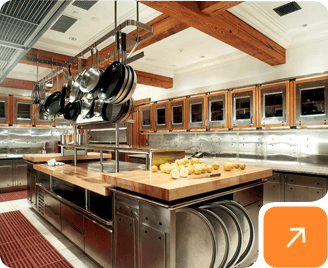

Food Processing / Manufacturing - Many states exempt purchases of commercial kitchen equipment used directly in the production of food or in the manufacturing process. Rules and definitions vary by state and are subject to your specific facts and circumstances.

Construction Contractors - Many states do not consider commercial kitchen equipment, including exhaust hoods and fans, to be part of the real property (building). In these instances, the contractor may be considered an exempt reseller. Rules and definitions vary by state and are subject to your specific facts and circumstances.

Tax Exempt Organizations - An organization may qualify for exemption from sales tax if it is organized and operated exclusively for one or more of the following purposes:

- Religious

- Charitable

- Scientific

- Testing for public safety

- Educational

- Fostering national or international amateur sports competition

- Prevention of cruelty to children or animals

CUSTOM FABRICATOR

CUSTOM FABRICATOR