We use cookies to help improve our services, make personal offers, and enhance your experience. If you do not accept optional cookies below, your experience may be affected. If you want to know more, please read the Learn more.

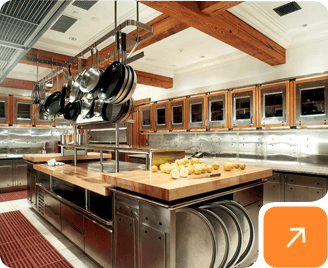

SBA Restaurant Revitalization

ELIGIBILITY

1. Who is an “eligible entity” for Restaurant Revitalization Fund Grants (RRFG)?

Entities that own a place of business where the public or patrons assemble for the primary purpose of being served food or drink, including a:

Restaurant, Food Stand, Food Truck, Food Cart;

Snack and Nonalcoholic Beverage Bar;

Caterer;

Bar, Lounge, Saloon, Tavern;

An Inn;

Brewery, Brewpub, Microbrewery, Taproom, Tasting room;*

Bakery;*

Winery;*

Distillery;*

A licensed facility or premise of a beverage alcohol producer where the public may taste, sample, or purchase products;

Other similar place of business in which the public or patrons assemble for the primary purpose of being served food or alcohol.

*Eligibility may be limited for the following entities:

![]() Bakery; Brewery; Brewpub; Distillery; Microbrewery; Taproom; Tasting Room; Wineries

Bakery; Brewery; Brewpub; Distillery; Microbrewery; Taproom; Tasting Room; Wineries

Eligibility is limited to entities that have onsite sales to the public of at least 33% of gross receipts.

When applying, entities must provide documents showing onsite sales to the public comprise at least 33% of gross receipts for each of the years included in grant funding calculation. Documents may include Tax and Trade Bureau reports filed or to be filed that cover the period for which it is reporting gross receipts, or if applicable, eligible expenses.

For entities who opened in 2020 or have not yet opened, the original business model should have contemplated at least 33% of gross receipts in onsite sales to the public.

![]() Inn

Inn

Eligibility is limited to entities that have onsite sales of food and beverage to the public of at least 33% of gross receipts.

When applying, entities must provide documents showing onsite sales to the public comprise at least 33% of gross receipts for each of the years included in grant funding calculation. Documents may include Tax and Trade Bureau reports filed or to be filed that cover the period for which it is reporting gross receipts, or if applicable, eligible expenses.

For entities who opened in 2020 or have not yet opened, the original business model should have contemplated at least 33% of gross receipts in onsite food and beverage sales to the public

2. What disqualifies an entity from RRFG eligibility?

The following circumstances would preclude an otherwise eligible entity from receiving an RRFG:

As of March 13, 2020, the entity owns or operates (together with any affiliated business) more than 2O locations, regardless of whether those locations do business under the same or multiple names.

The entity has received a Shuttered Venues Operations Grant (SVOG) or has a pending SVOG application.

The entity is a publicly traded corporation or is majority owned and controlled by a publicly traded corporation.

The entity does not have a valid business tax identification number (Employer Identification Number, Social Security Number, or Individual Taxpayer Identification Number).

The entity is a state- or local government-owned or operated business.

The entity is permanently closed.

The entity is a non-profit.

The entity filed for bankruptcy under Chapter 7 or is liquidating under Chapter 11.

The entity has filed for bankruptcy under Chapter 11, 12, or 13 but does not have an approved plan for reorganization.

3. When does an eligible entity have to have been established to receive an RRFG?

An entity must have been established to incur eligible expense before March 11, 2021.

If an entity was not open prior to January 1, 2020, it is still eligible for RRFG. Even if an entity has not opened by the date of the application, it can apply for eligible expenses incurred in preparing to open. For entities opened or that were planning to open after January 1, 2020, the grant fund eligibility formula is:

[Eligible Expenses Incurred February 15, 2020 to March 11, 2021] – [2020 Gross Receipts] – [PPP Loans] = GRANT FUND

4. What is the minimum and/or maximum amount an entity can receive?

The SBA has a minimum grant amount of $1,000 for eligible entities. The maximum grant amount is $5M per location and $10M total for the eligible entity.

5. Can a nonprofit organization which owns an eligible entity apply for an RRFG?

No. Nonprofits are not eligible for RRFG.

6. Is an entity that applied for and received a 1st draw and a 2nd draw Paycheck Protection Program (PPP) loan eligible to apply for an RRFG?

Yes. However, the RRFG will be reduced by the total amount of PPP Loans.

7. Are franchisees considered eligible entities?

Yes, if the applicant is operating under a franchise or similar agreement that meets the Federal Trade Commission definition of a franchise in 16 CFR 436. The franchise must be listed on the SBA Franchise Directory with a franchise identifier code to ensure the franchise is eligible under SBA’s other eligibility criteria (e.g., 13 CFR § 120.110). For entities not listed on the Directory, the franchisor must submit the Franchise Disclosure Document (or other agreement) and all other documents a franchisee is required to sign to franchise@sba.gov for review of SBA’s other eligibility criteria (e.g., 13 CFR § 120.110).

The National Restaurant Association is seeking clarification from the SBA regarding whether “franchise” restaurants retain their application time stamp for funding while the franchise office determines eligibility.

8. What is the definition of an “affiliated business”?

An “affiliated business” is a business that is itself an eligible entity and has an equity or right to profit distributions of not less than 50% in the RRFG applicant or the contractual authority to control the direction of the RRFG applicant as of March 13, 2020.

9. Do the SBA “Affiliation Rules” apply?

No. The statute included a definition for “affiliated business,” so the SBA Affiliation Rules found at 13 C.F.R.

121.301 for financial assistance do not apply.

10. A franchise restaurant is an eligible entity under the RRFG rules but its franchisor is a publicly traded company. Is the entity eligible?

Yes, as long as the RRFG applicant is listed on the SBA Franchise Directory, otherwise qualifies for the RRFG, and the publicly traded company is not an “affiliated business” (i.e., does not have an equity or right to profit distributions of not less than 50% or the contractual authority to control the direction of the business as of March 13, 2020).

APPLICATION

11. What documents does an eligible entity need to prepare to apply for a RRFG?

![]() An application form and the IRS Form 4506-T, as well as gross receipts documentation.

An application form and the IRS Form 4506-T, as well as gross receipts documentation.

The application: SBA Form 3172, completed, initialed, and signed.

Verification for Tax Information: IRS Form 4506-T, completed and signed by applicant. Completion of this form digitally on the SBA Platform will satisfy this requirement.

Gross Receipts Documentation: Any of the following documents demonstrating gross receipts and, if applicable, eligible expenses:

Business tax returns (IRS Form 1120 or IRS Form 1120-S)

IRS Form1040 Schedule C; IRS Form 1040 Schedule F

For a partnership: partnerships IRS Form 1065 (including K-1s)

Bank statements

Externally or internally prepared financial statements such as Income Statements or Profit and Loss Statements

Point of sale report(s), including IRS Form 1099-K

![]() NOTE:

NOTE:

Applicants in operation before January 1, 2019 must supply gross receipts for 2019 and 2020.

Applicants in operation through part of 2019 must supply gross receipts for 2019 and 2020.

Applicants that began operations on or between January 1, 2020 and March 10, 2021 and applicants that have not yet opened as of March 11, 2021, but have incurred eligible expenses, must supply documentation of gross receipts and eligible expenses for the length of time in operation.

![]() For applicants that are a Bakery, Brewery, Brewpub, Distillery, Microbrewery, Taproom, Tasting Room, Wineries:

For applicants that are a Bakery, Brewery, Brewpub, Distillery, Microbrewery, Taproom, Tasting Room, Wineries:

In addition to the above documents, further documentation is required to show onsite sales to the public comprise at least 33% of gross receipts for 2019. These may include 2019 Tax and Trade Bureau (TTB) Forms filed, state or local government forms filed, or internally created reports from inventory management, sales reporting, or accounting software.

![]() For applicants that are an Inn:

For applicants that are an Inn:

In addition to the above documents, further documentation is required to show onsite sales to the public comprise at least 33% of gross receipts for 2019. These may include internally created revenue reports or accounting reports.

12. Do restaurants need to receive a DUNS number and register at www.SAM.gov in order to apply for a RRFG?

No. On March 30, the SBA clarified this in order to streamline and simplify the application process for eligible entities.

13. Which Point of Sale (POS) vendors are working with the SBA on this program?

Several POS vendors are working with the SBA. Full-service vendors are providing a unique, custom portal for their customers to submit applications that will automate the collection of transaction history to expedite the application process. Applicants submitting via a full-service vendor do NOT need to submit an application via the SBA Portal.

14. How do I apply?

When the application period opens, there are three ways to apply for a Restaurant Revitalization grant:

Online: restaurants.sba.gov

By phone: (844) 279-8898

Through a recognized POS vendor

15. Does the SBA provide assistance with applications?

Yes. There is a call center available at 1-844-279-8898 (Hours are Monday-Friday 8am-8pm ET), and local SBA District Offices: https://www.sba.gov/funding-programs/loans/covid-19-relief-options https://www.sba.gov/local-assistance.

16. As the SBA plans to award grants “in the order in which applications are received,” is that order based on the entities of different sizes based on annual gross receipts? For example, the order in which applications are received based on each level of company size?

Entities that can certify that they meet the definition of a woman-owned, veteran-owned, or socially and economically disadvantaged small business will be given priority for award if their application is filed within the first 21 days the application is open for submissions. SBA will accept applications from all eligible applicants during the first 21 days, but will only distribute funds for approved applications that have self-certified as meeting the eligibility requirements for priority ownership. In addition, $5 billion is set aside for applicants with 2019 gross receipts of up to $500,000. An additional $4 billion is set aside for applicants with 2019 gross receipts from $500,001 to $1,500,000. Lastly, an additional $500 million is set aside for applicants with 2019 gross receipts of up to $50,000.

17. Will banks, local lenders, or community development financial institutions be involved in RRFG?

No. The RRFG program is administered through the SBA.

18. How will entities receive a RRFG?

SBA will deposit the funds directly into the bank account identified in the application. However, the SBA requires the disbursement to be placed into the applicant’s commercial business account. Using the SBA automatic linking service will expedite this process. In cases of sole proprietors operating without a commercial account, the SBA will require supporting documentation to demonstrate this account is utilized for restaurant operations, and it is owned by the sole proprietor. SBA will not allow funding accounts with limited (less than 3 months) history or unrelated ownership to the applicant.

19. Do I have to provide ownership information?

Yes, the application requires disclosure of all owners with 20% or more equity of the applicant.

ELIGIBLE RRFG AMOUNT

20. How much can an eligible entity receive?

An entity can receive a tax-free federal grant equal to the amount of its pandemic-related revenue loss, subtracted by the total amount it received in all PPP loans.

• For entities opened before 2019:

[Gross receipts of 2019] – [Gross receipts of 2020] – [Total amount received in PPP loans (1st and 2nd Draw)] = Restaurant Revitalization Fund Grant

• For entities opened during 2019:

[Average monthly gross receipts of 2019 multiplied by 12] - [Gross receipts of 2020] - [Total amount received in PPP loans (1st and 2nd Draw)]

= Restaurant Revitalization Fund Grant

OR

[Eligible expenses incurred February 15, 2020 to March 11, 2021] - [Gross receipts] - [Total amount received in PPP loans (1st and 2nd Draw)]

= Restaurant Revitalization Fund Grant

· For entities opened during 2020-2021:

[Eligible expenses incurred February 15, 2020 to March 11, 2021] - [Gross receipts] - [Total amount received in PPP loans (1st and 2nd Draw)]

= Restaurant Revitalization Fund Grant

Aggregate grants made to an eligible entity, and any affiliated businesses of the eligible entity, are limited to $5M per physical location and $10M total for the eligible entity.

21. How does the SBA calculate gross receipts?

Gross receipts mean all revenue in whatever form received or accrued from whatever source, including from the sales of products or services, interest, dividends, rents, royalties, fees, or commissions, reduced by returns and allowances. Generally, receipts are considered “total income” (or in the case of a sole proprietorship “gross income”) plus “cost of goods sold” as these terms are defined and reported on IRS tax return forms— this includes Form 1120 for corporations; Form 1120-S for S corporations; Form 1120, Form 1065 or Form 1040 for LLCs; Form 1065 for partnerships; Form 1040, Schedule C for other sole proprietorships.

Receipts do not include net capital gains or losses; taxes collected for and remitted to a taxing authority if included in gross or total income, such as sales or other taxes collected from customers and excluding taxes levied on the concern or its employees; proceeds from transactions between a concern and its domestic or foreign affiliates; and amounts collected for another by a travel agent, real estate agent, advertising agent, conference management service provider, freight forwarder or customs broker.

Subcontractor costs, reimbursements for purchases a contractor makes at a customer’s request, investment income, and employee-based costs such as payroll taxes are not excluded from receipts.

Gross receipts for 2020 do not include any amounts received from any Paycheck Protection Program (PPP) loan, SBA Section 1112 debt relief payments, or from any SBA Economic Injury Disaster Loan (EIDL) loan, EIDL advance, targeted EIDL advance, state and local small business grants (via CARES Act or otherwise).

22. Are PPP loans, Economic Injury Disaster Loans (EIDL), advance grants from EIDL, SBA Section 1112 debt relief payments, targeted advance grants, and/or state and local small business grants (via CARES Act or otherwise) included within gross receipts for 2020?

It is unlikely these emergency funds will be included in gross receipts calculations for RRFG. The National Restaurant Association is actively seeking to exclude these funds.

INTERACTION WITH OTHER FEDERAL COVID-19 RELIEF PROGRAMS

23. If I returned my 1st Draw PPP loan in whole before the applicable safe harbor deadline on May 18, 2020, is it deducted from my eligible grant amount?

No. If an entity returned a PPP loan during the Safe Harbor period, it is not deducted from the RRFG amount.

24. Is an EIDL deducted from eligible RRFG amounts?

No.

25. Is an EIDL advance grant or target advance grant deducted from eligible RRFG amounts?

No.

26. Are COVID-19 Employee Retention Tax Credits (ERTC) taken in 2020 and/or 2021 deducted from eligible RRFG amounts?

No. However, an entity is restricted from collecting ERTC for any “eligible wages” paid with RRFG funds.

PRIORITIZATION

27. How is a small business concern “owned and controlled by women” defined?

An eligible small business concern owned and controlled by women must (1) meet the SBA’s Size Standard requirements for a small business concern; (2) be at least 51% owned by one or more women; and (3) have the management and daily business operations controlled by one or more women. The concern must also qualify as small under the SBA Size Standards corresponding to the 6-digit North American Industry Classification System (NAICS) code. Applicants must self-certify eligibility as a small business concern owned and controlled by women for priority in awarding the grant.

28. How is a small business concern “owned and controlled by veterans” defined?

An eligible small business concern owned and controlled by veterans must (1) meet the SBA’s Size Standard requirements for a small business concern; (2) be at least 51% owned by one or more veterans; and (3) have the management and daily business operations controlled by one or more veterans. The concern must also qualify as small under the SBA Size Standards per the 6-digit NAICS code. Applicants must self-certify eligibility as a small business concern owned and controlled by veterans for priority in awarding the grant.

29. How is a small business concern “owned and controlled by socially and economically disadvantaged individuals” defined?

A small business concern owned and controlled by socially and economically disadvantaged individuals is a business entity organized for profit, with a place of business located in the United States, and which operates primarily in the U.S. that is considered small in accordance with SBA’s size standards at 13 CFR § 121.201. Additionally, it is at least 51% owned by one or more socially and economically disadvantaged individuals, an Alaska Native Corporation, an economically disadvantaged Indian tribe, or an economically disadvantaged Native Hawaiian Organization, and the management and daily business operations of the applicant are controlled by one or more socially and economically disadvantaged individuals, an Alaska Native Corporation, an economically disadvantaged Indian tribe, or an economically disadvantaged Native Hawaiian Organization.

Individuals who are members of the following groups are presumed to be socially disadvantaged:

Black Americans

Hispanic Americans

Native Americans (including Alaska Natives and Native Hawaiians)

Asian Pacific Americans

Subcontinent Asian Americans

Economically disadvantaged individuals are those socially disadvantaged individuals whose ability to compete in the free enterprise system has been impaired due to diminished capital and credit opportunities as compared to others in the same business area who are not socially disadvantaged. In assessing economic disadvantage, SBA will look at whether the net worth of the individual claiming disadvantage is less than $750,000, excluding his or her ownership interest in the applicant, primary personal residence, contingent liabilities, funds invested in an official retirement account, or income received from an S-corporation, LLC, or partnership if the individual provides documentation that the income was reinvested in the firm. SBA will also look at whether the adjusted gross income of the individual averaged over the preceding three years exceeds $350,000. Income received from an S-corporation, LLC or partnership that is reinvested in the firm or used to pay taxes arising in the normal operations of the firm is excluded. Finally, SBA will look at whether the fair market value of all the individual’s assets (excluding his or her ownership interest in the applicant, primary personal residence, or funds invested in an official retirement account) exceeds $6 million. An individual who exceeds any of these thresholds for net worth, personal income, or total assets will generally be deemed to not be economically disadvantaged.

Applicants must self-certify eligibility as a small business concern owned and controlled by socially and economically disadvantaged individuals for priority in awarding the grant.

ELIGIBLE EXPENSES

30. What are the eligible expenses for RRFG?

The following expenses are eligible if incurred between February 15, 2020 and March 11, 2023:

Business payroll costs, including sick leave and costs related to the continuation of group health care, life, disability, vision, or dental benefits during periods of paid sick, medical, or family leave, and group health care, life, disability, vision, or dental insurance premiums.

Payments on any business mortgage obligation (both principal and interest; note: this does not include any prepayment of principal on a mortgage obligation).

Business rent payments, including rent under a lease agreement (note: this does not include any prepayment of rent).

Business debt service (both principal and interest; note: this does not include any prepayment of principal or interest).

Business utility payments for the distribution of electricity, gas, water, telephone, or internet access, or any other utility that is used in the ordinary course of business for which service began before March 11, 2021.

Business maintenance expenses including maintenance on walls, floors, deck surfaces, furniture, fixtures, and equipment.

Construction of outdoor seating.

Business supplies, including protective equipment and cleaning materials.

Business food and beverage expenses, including raw materials for beer, wine, or spirits.

Covered supplier costs, which is an expenditure made by the eligible entity to a supplier of goods for the supply of goods that are essential to the operations of the entity at the time at which the expenditure is made and is made pursuant to a contract, order, or purchase order in effect at any time before the receipt of Restaurant Revitalization funds; or with respect to perishable goods, a contract, order, or purchase order in effect before or at any time during the covered period.

Business operating expenses, which is defined as business expenses incurred through normal business operations that are necessary and mandatory for the business (e.g. rent, equipment, supplies, inventory, accounting, training, legal, marketing, insurance, licenses, fees). Business operating expenses do not include expenses that occur outside of a company’s day-to-day activities.

![]() NOTE: Past-due expenses are eligible if they were incurred beginning on February 15, 2020 and ending on March 11, 2023.

NOTE: Past-due expenses are eligible if they were incurred beginning on February 15, 2020 and ending on March 11, 2023.

31. Will the SBA require entities to demonstrate how all grant funds were used on eligible expenses?

Yes. By December 31, 2021, recipients must report through the application portal how much of the award has been used against each eligible use category. If the entity fully expends its funds prior to

December 31, 2021, it will be asked to certify in the application portal that proceeds have been used on eligible expenses.

Recipients that do not fully expend award funds prior to December 31, 2021 will be required to complete annual reporting submissions until funds are fully expended.

SBA reserves the right to request supplemental documentation needed to validate the certification.

32. What is the time frame for when these eligible expenses can be—or could have been— incurred?

An eligible entity can use grant funds for eligible expenses incurred from February 15, 2020 until March 11, 2023.

33. What happens if the entity does not spend all the grant funds by the end of the covered period?

If an entity cannot use all grant funds or permanently ceases operations on or before March 11, 2023, the entity must return the unused funds to the U.S. Department of Treasury.

34. Entities who met eligible expenses might have put them on a personal- or business-line of credit—can the entity pay the credit card bill to satisfy the eligible expense? If so, is the interest on this transaction included as an eligible expense?

Yes.

35. Is the repayment of SBA 7(a) loans, PPP loans or EIDLs an eligible expense?

Yes.

PUBLIC DISCLOSURE

36. Will RRFG applicants be made public?

This is uncertain and has not been clarified in federal guidance.

37. Will RRFG recipients be made public? If so, how long after they accept the funds?

While the American Rescue Plan did not specify a public reporting process or mechanism for grant recipients and/or grant amounts, it is a reasonable expectation that federal grants would be subject to transparency requirements, including the Freedom of Information Act. For example, some PPP loan recipients were originally released by company name and by category of funding in June 2O2O. Subsequently, a federal court ordered the SBA under the Freedom of Information Act to release all PPP loan recipients by business name and loan amount.

TAXABILITY

38. Will the RRFG be taxed as federal gross income?

Grants will not be included as federal taxable gross income by the IRS

39. Will entities be able to deduct federal tax expenses paid with RRFG funds?

Yes, the law states that “no deduction shall be denied, no tax attribute shall be reduced, and no basis increase shall be denied, by reason of the exclusion from gross income.”

40. Can a state tax RRFG funds or disallow standard and necessary tax deductions on expenses paid with RRFG funds?

A state may be able to increase an eligible entity’s state tax liability associated with its acceptance of a federal RRFG. It will be important for an entity to be aware of its state’s tax conformity with the federal code and how its state plans to treat the RRFG funds. Many states automatically accept changes to the federal tax code, which protect the tax status of RRFG.

41. How are different organizations situated for RRFG?

Non-taxable income on the grant is added to the basis for S Corp shareholders and the partner’s basis in a partnership.

LEARN MORE & GET UPDATES

Visit RestaurantsAct.com

CUSTOM FABRICATOR

CUSTOM FABRICATOR